Do you work for an international company with multiple locations in Europe? If so, it’s common for employees to be loaned out between different entities for projects. But how does the billing of those hours actually work? That’s where intercompany hourly rates come into play. And guess what? There are quite a few tax pitfalls involved. In this blog post, we’ll dive into the world of intercompany hourly rates and explain what you need to keep in mind.

Why intercompany hourly rates?

Let’s start with the basics. Why do we need intercompany hourly rates? Simple: When an employee from location A works for location B, location A incurs costs for that employee, like salary, workspace, etc. These costs need to be charged to location B. That’s where intercompany hourly rates come in. This rate determines how the hours of the loaned employee are billed internally.

Sounds logical, right? Unfortunately, it’s not that straightforward. The tax authorities closely scrutinise whether these rates are in line with market standards. You can’t just use any arbitrary amount. There are rules from a tax perspective, known as transfer pricing. You need to comply with these rules, or you risk facing fines and additional tax assessments. So, let’s dig a little deeper!

The Arm’s Length Principle

The primary tax rule for intercompany transactions is the Arm’s Length Principle. This means that the terms of the transaction between related entities (like two locations of the same company) should be comparable to the terms that independent parties would agree upon. So, the hourly rates you use internally should match the rates you would charge an external client for similar services.

But how do you determine if your rates are arm’s length? For that, you need to conduct a transfer pricing analysis. This is essentially a market study where you look at what similar services cost in the market. Based on that, you set an internal rate that aligns with those findings. It’s important to document this thoroughly, so you can demonstrate to the tax authorities that your rates are market-compliant.

Cost-Plus method

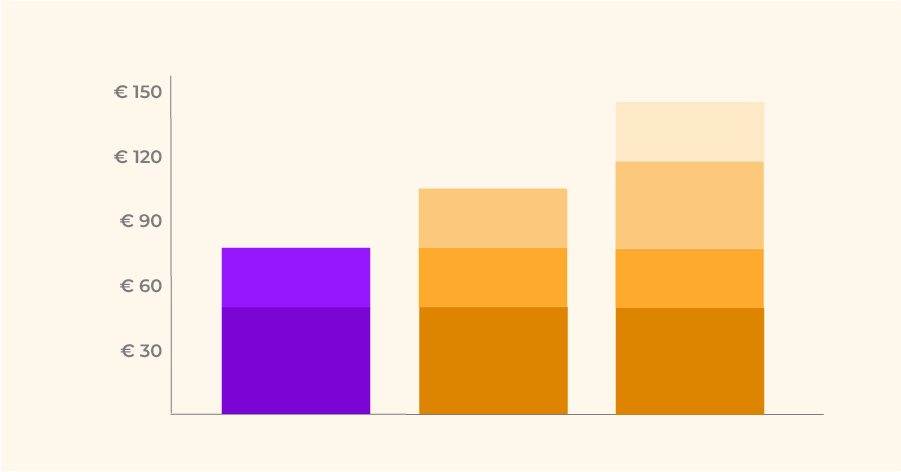

A commonly used method to determine intercompany hourly rates is the cost-plus method. Here, you take the costs of the service (like salary costs, indirect costs, etc.) and add a profit margin on top. That profit margin is your compensation for the business risk you’re taking on. But how much profit margin can you charge according to the tax authorities?

It depends on the complexity of the service and the added value you provide. For routine services with little added value, like administrative tasks or payroll, you can apply a lower profit margin compared to unique or specialist services. So, you’ll need to determine and justify the profit margin for each type of service.

For example, let’s say the salary costs for an employee are €50 per hour. The indirect costs are €25 per hour. This brings the total cost to €75 per hour. If you apply a profit margin of 10%, you arrive at an intercompany hourly rate of €82.50. Make sure you can justify why that 10% is a market-rate profit margin for the type of service provided.

Making agreements in advance

To avoid discussions with the tax authorities, you can make pre-agreements about your intercompany hourly rates in a so-called Advance Pricing Agreement (APA). This is an agreement with the tax authorities where you agree on which transfer pricing method and rates you will use for a specified period. The advantage is that you have certainty in advance and reduce the risk of any corrections later on.

Keep in mind that pursuing an APA takes time and resources. You’ll need to conduct a thorough transfer pricing analysis and negotiate with the tax authorities. But it can definitely be worthwhile, especially for companies with many intercompany transactions.

Be consistent

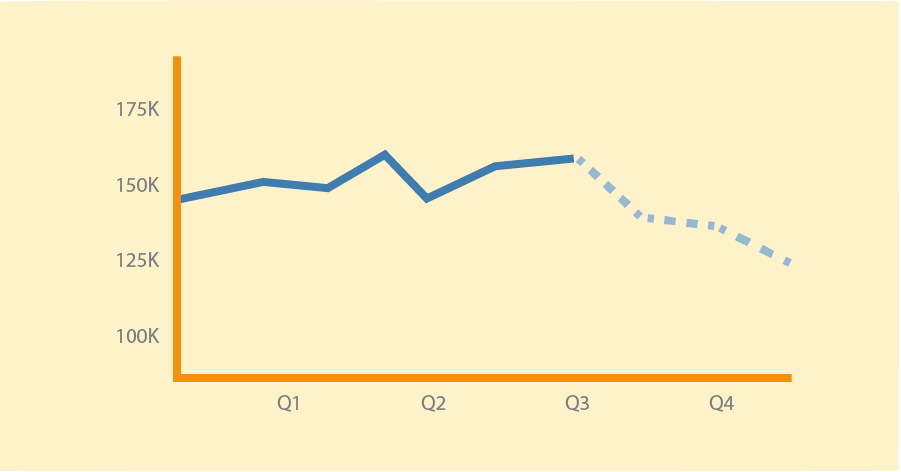

Lastly, a crucial point: be consistent with your intercompany hourly rates. You can’t charge €80 per hour one year and then suddenly switch to €120 per hour the next year for the same service. That won’t look credible to the tax authorities. So, make sure you have a consistent policy for your intercompany rates and only adjust them when there’s a valid reason, like changed market conditions.

Of course, it’s possible for service costs to rise, for example, due to wage increases or inflation. In such cases, it makes sense for your rates to increase as well. But keep an eye on the market as well. If market prices remain the same, you can’t just raise your rates without a solid justification.

Conclusion

Intercompany hourly rates are an essential tool for internationally operating companies to settle internal costs. However, it’s vital to substantiate these rates from a tax perspective. The Arm’s Length Principle is key: ensure your rates are market-compliant and back this up with a thorough transfer pricing analysis. Consider an APA if you want certainty about your rates in advance. And finally, be consistent in your policy. This way, you can avoid issues with the tax authorities and confidently apply your intercompany hourly rates.